when are property taxes due in illinois 2019

Property Taxes and Fees. The Illinois Department of Revenue does not administer property tax.

The Cook County Property Tax System Cook County Assessor S Office

State statute allows a.

. Paying First Installment Property Taxes Early. This necessitates passage of a property tax levy in advance of the budget year in which these funds are used. See the Top 50 Largest Tax Increases since 2000 by Chicago ward and suburb.

The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3. Make and view Tax Payments get current Balance Due. View and print Tax Statements and Comparison Reports.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Election Night Results Contact Calendar Agendas Minutes Maps Employment. Sangamon County committed to moving due dates on property taxes to June 12 and Sept.

Shannon Antinori Patch Staff. Taxpayers who do not pay property taxes by the due date receive a penalty. In most counties property taxes are paid in two installments usually June 1 and September 1.

Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020. It is managed by the local governments including cities counties and taxing districts. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Information about Prior Year Property Taxes. As you can see the City of Decatur receives 16 of property tax paid by residents. View Ownership Information including Property Deductions and Transfer History.

20-Year Property Tax History. Current property tax due dates are. Tax amount varies by county.

Welcome to Madison County Illinois. Physical Address 18 N County Street Waukegan IL 60085. 5 Things To Know In Illinois After being extended three months because of the coronavirus crisis the 2019 tax deadline is fast approaching.

2nd installment due September 3 2019. Martin Luther King Jrs birthday. Collecting property taxes on real estate and mobile homes.

Illinois has one of the highest average property tax rates in the. Contact your county treasurer for payment due dates. Welcome to Ogle County IL.

The most common overlapping districts are used for illustrative purposes. City of Decatur Property and Overlapping Governmental Tax Rates. This next chart and graph shows the City and overlapping governmental taxing districts.

Due Dates Tax Year 2021 First Installment Due Date. State law requires a 15 percent interest fee per month on late payments. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

1st installment due date. July 15 Tax Deadline. Brophy is encouraging all residents to use one of the alternate methods to pay.

You will receive a statement with upcoming due dates in the Spring. Prepare your 2019 state tax 1799. Even if the payment is.

Any property owner may pay their second installment of the 2019 property tax by October 1 without any penalties or late fees. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. In the calendar year 2019 we will be paying real estate taxes for the 2018 year.

Property tax due dates for 2019 taxes payable in 2020. For contact information visit. Scheduled to be held May 12 through May 18 2022.

Property Tax First Installment Due Date. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Welcome to Property Taxes and Fees.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Penalty be assessed for payments made after the due date. Property tax bills mailed.

Mobile Home Due Date. If Taxes Were Sold. If you are a taxpayer and would like more information or forms please contact your local county officials.

If taxes are not paid after the second installment date in addition to the penalty additional fees may be added. View and print Assessed Values including Property Record Cards. General Information and Resources - Find information.

Illinois is extending the 2019 tax year filing and payment due date for C corporations who file Form IL-1120 from April 15 2020 to July 15 2020. Property TaxesMonday - Friday 830 - 430. Cook County Treasurers Office - Chicago Illinois.

January 20 2020 - Dr. Use this application to. Property TaxesMonday - Friday 800 - 400.

Tuesday March 1 2022. 100 Free Federal for Old Tax Returns. Property tax payments are made to your county treasurer.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. 1st installment due June 3 2019. Property Tax Second Installment Due Date.

12 to give residents extra time to obtain unemployment stimulus checks or other relief. Enjoy online payment options for your convenience. Voter Election Info.

3 penalty interest added per State Statute. The Official Government Website of Macon County Illinois Search for. 15 penalty interest added per State Statute.

Tax Year 2020 Tax Bill Analysis. Welcome to Jo Daviess County Illinois. Last day to submit changes for ACH withdrawals for the 1st installment.

Property Reports and Tax Payments. 173 of home value. 2018 Real Estate Property Taxes Payable 2019 Due Dates.

Ad Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. January 1 2020 - New Years Day. 45 penalty interest added per State Statute.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Consequently City Council typically approves a property tax levy amount that satisfies the procedural requirements of law and gives City Council a small margin of flexibility in terms of determining at a later date the final property.

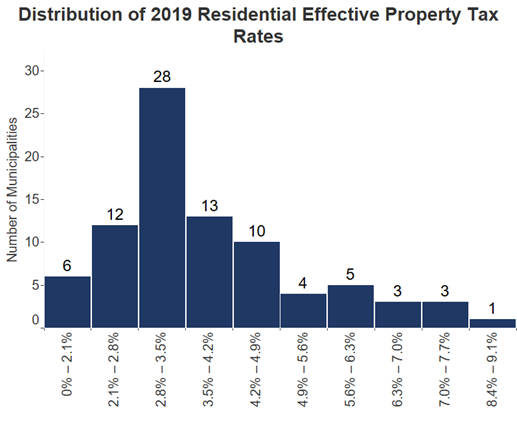

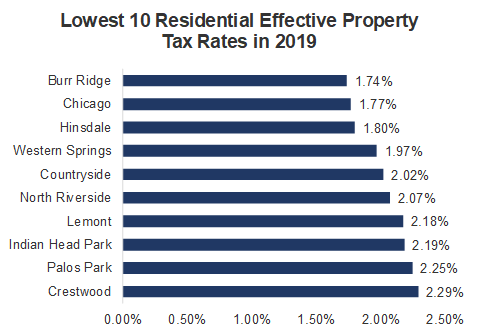

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Pin On People That Won S The Lottery But Why Not Me

Missouri Legislation Would Shield Cryptocurrency From Some Taxes In 2022 Blockchain Technology Blockchain Cryptocurrency

Tax Information Village Of River Forest

The Cook County Property Tax System Cook County Assessor S Office

Pin By Keiram On We Hunt The Flame Sentences Chemistry Ya Fiction

Property Tax Village Of River Forest

Property Tax City Of Decatur Il

Property Tax Prorations Case Escrow

Johnson Re Max Real Estate Agent Real Estate Investor Real Estate Real Estate Buying

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Your Property Tax Assessment Why It Pays To Hire A Law Firm Senior Discounts Property Tax Car Insurance Rates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Need Any More Proof Than This Find A Job New Opportunities Names